LAST UPDATED 2016

THE MARKET

There is a high demand for entertainment industry artists interested in living with others in their field. Tenants are not just paying for a bed and a roof, but a community to collaborate with each other and benefit one another. This experience is motivating and inspiring as they pursue their aspirations in the film and music industries.

The market demand for our 'shared music/film amenities' business model is extremely high so we are in need of expanding quickly. We maintain 100% occupancy at all our properties with a 2 to a 3-month waiting list of very high caliber potential tenants. (more info).

As you may know, Los Angeles has a surge of the youthful Millennials and X-Generation folks migrating from other states to pursue their passion for film and music. These youths are no doubt obliged to reduce their cost of living by sharing the basic amenities. Even though they will have shared bathrooms and kitchens, they will be giant spaces with modern and upscale designs, thus considering it Class A / high-end housing. (This may be the only reason we would demolish or renovate existing separated spaces on an existing building. We aim to do affordable, minimal, and functional construction.)

In 2012, Integra Realty Resources stated other than class A office properties, the rest of the sector is struggling with high vacancy rates, lack of buyers, and lack of financing.

Downtown Los Angeles Demographics:

With 45,500 residents, 500,000+ weekday employees, and more than 10million annual non-local visitors, Downtown Los Angeles has become Southern California’s economic engine. The 45,518 persons residing in Downtown is a strong 15.1% rise from 2008 (4th quarter).

Nearly one-fifth or 19% of Downtown residents are employed in arts/ entertainment, business/professional/technical services employee the slightly higher 20% majority, by far the top two fields. There is a large migration from other states as well as international locations into Los Angeles as a result of people wanting to be closer to the entertainment capital of the world. There is a giant lack of music-friendly places. Demand is growing exponentially for such accommodations.

As by the LADT 4Q Housing Book, from the adoption of the reuse ordinance, residential property has been the largest property type invested from 2000 to 2012 at $5,927,100,000. Mixed-Use came in second, followed by Civic/Institutional, Arts/Entertainment, and finally Commercial.

Ethnicity: The largest group, Caucasians, remains constant at 53%(versus 54%in 2008), with Asian-Americans/Pacific Islanders at 22%(21%) and Hispanics/Latinos at nearly 18%(17%), whereas African-Americans at 6.5%slipped slightly from 8%in 2008.

Gender: 54%(53%) of Downtown residents are female and 46%(47%) are male.

Age: Downtown residents’ median age is 32.5 years.

Education: 80% of Downtown residents completed four-year college or higher levels of education.

Housing Stats:

A total of 28,861 residential units are located in Downtown LA, up 11.0%from2008 (4th quarter).

The average number of residents per Downtown household remained constant at 1.8.

Downtown residents spent a median of 1.7 (2.3) years at their current residence.

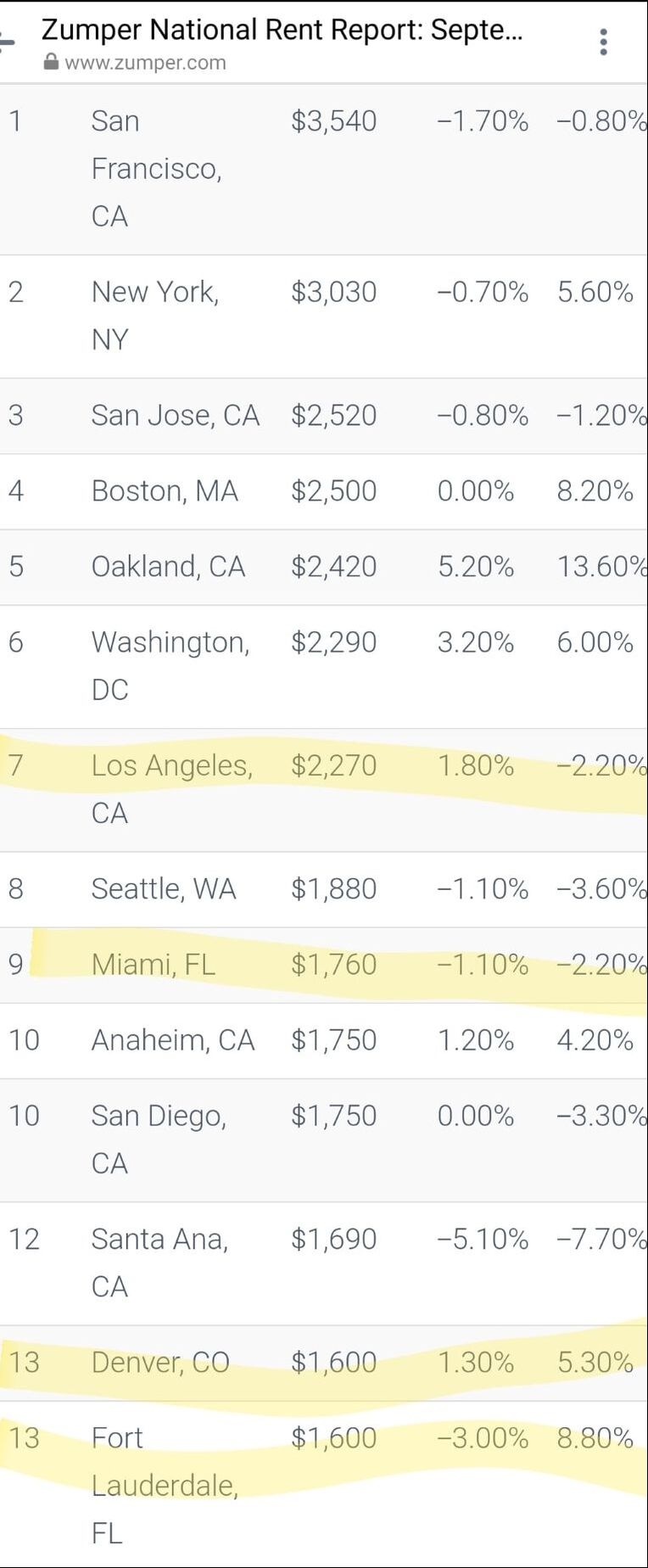

According to Hotpads.com, the median rent for a private room in a shared building in Downtown is $1,575.

The study results underscore that Downtown LA is supported by a strong residential and employment base. Downtown LA is alive with new developments, fine and eclectic restaurants, unique businesses, exciting events and activities, and a new wave of residents entering the market. Downtown LA is economically viable, culturally vibrant and continues to grow strongly. Downtown LA is the Southern California hub for economic activity, employment, and transportation. It is the region’s premier destination for entertainment, nightlife, sports events, cultural arts, and special events. All signs point to sustained growth and viability now and into the near future.

There are currently other properties that have done the same business model of private rooms with shared bathrooms and kitchens but they are very strict on applicants because of demand and require a minimum of a 1-year lease. For initial occupancy, we will provide month to month leasing with no credit checks. Most students out of college do not have great credit scores.

Facts at the end of 2016:

The market demand for our 'shared music/film amenities' business model is extremely high so we are in need of expanding quickly. We maintain 100% occupancy at all our properties with a 2 to a 3-month waiting list of very high caliber potential tenants. (more info).

As you may know, Los Angeles has a surge of the youthful Millennials and X-Generation folks migrating from other states to pursue their passion for film and music. These youths are no doubt obliged to reduce their cost of living by sharing the basic amenities. Even though they will have shared bathrooms and kitchens, they will be giant spaces with modern and upscale designs, thus considering it Class A / high-end housing. (This may be the only reason we would demolish or renovate existing separated spaces on an existing building. We aim to do affordable, minimal, and functional construction.)

In 2012, Integra Realty Resources stated other than class A office properties, the rest of the sector is struggling with high vacancy rates, lack of buyers, and lack of financing.

Downtown Los Angeles Demographics:

With 45,500 residents, 500,000+ weekday employees, and more than 10million annual non-local visitors, Downtown Los Angeles has become Southern California’s economic engine. The 45,518 persons residing in Downtown is a strong 15.1% rise from 2008 (4th quarter).

Nearly one-fifth or 19% of Downtown residents are employed in arts/ entertainment, business/professional/technical services employee the slightly higher 20% majority, by far the top two fields. There is a large migration from other states as well as international locations into Los Angeles as a result of people wanting to be closer to the entertainment capital of the world. There is a giant lack of music-friendly places. Demand is growing exponentially for such accommodations.

As by the LADT 4Q Housing Book, from the adoption of the reuse ordinance, residential property has been the largest property type invested from 2000 to 2012 at $5,927,100,000. Mixed-Use came in second, followed by Civic/Institutional, Arts/Entertainment, and finally Commercial.

Ethnicity: The largest group, Caucasians, remains constant at 53%(versus 54%in 2008), with Asian-Americans/Pacific Islanders at 22%(21%) and Hispanics/Latinos at nearly 18%(17%), whereas African-Americans at 6.5%slipped slightly from 8%in 2008.

Gender: 54%(53%) of Downtown residents are female and 46%(47%) are male.

Age: Downtown residents’ median age is 32.5 years.

Education: 80% of Downtown residents completed four-year college or higher levels of education.

Housing Stats:

A total of 28,861 residential units are located in Downtown LA, up 11.0%from2008 (4th quarter).

The average number of residents per Downtown household remained constant at 1.8.

Downtown residents spent a median of 1.7 (2.3) years at their current residence.

According to Hotpads.com, the median rent for a private room in a shared building in Downtown is $1,575.

The study results underscore that Downtown LA is supported by a strong residential and employment base. Downtown LA is alive with new developments, fine and eclectic restaurants, unique businesses, exciting events and activities, and a new wave of residents entering the market. Downtown LA is economically viable, culturally vibrant and continues to grow strongly. Downtown LA is the Southern California hub for economic activity, employment, and transportation. It is the region’s premier destination for entertainment, nightlife, sports events, cultural arts, and special events. All signs point to sustained growth and viability now and into the near future.

There are currently other properties that have done the same business model of private rooms with shared bathrooms and kitchens but they are very strict on applicants because of demand and require a minimum of a 1-year lease. For initial occupancy, we will provide month to month leasing with no credit checks. Most students out of college do not have great credit scores.

Facts at the end of 2016:

- Average New Apartment Size Drops by 70 Square Feet

- From micro-units to co-living, the biggest-or at least, most talked about trends in rental apartments today are all about living smaller, trading personal space for community amenities or hip urban locations. But how much has the needle actually moved toward smaller units?

- The decline in new affordable housing couldn’t come at a worse time. After nearly a decade when developers produced far fewer than their usual number of units of new housing of all types, the U.S. is facing a severe housing shortage. The new multifamily housing built is mostly priced for the luxury market. Affordable housing is very difficult to find. A new proposal in Congress would increase the funding for the LIHTC program, but the bill faces an uncertain future, especially in an election year.

- Less affordable housing, higher housing prices

- More than one in every three people in the U.S. struggles with the high cost of housing—the highest level ever recorded, according to the State of the Nation’s Housing, from the Joint Center for Housing Studies of Harvard University report for 2016. The number of people living in households that pay more than 50 percent of their income for housing has grown to 114 million, according to the study.

- Developers are producing fewer affordable apartments as the cost to produce each unit has been going up. High costs of construction and rising labor costs have made development more expensive. In addition, more affordable housing communities are being built for people with lower incomes, which can increase the cost to develop a property. “If you are going to use more LIHTCs per unit to develop properties, you’re going to have fewer units,” says Schwartz.

OUR COMPETITION

This section is important in any business venture. We honestly acknowledge all competition and describe how Artist Housing differs from other providers.

|

Co-Living Comparables

|

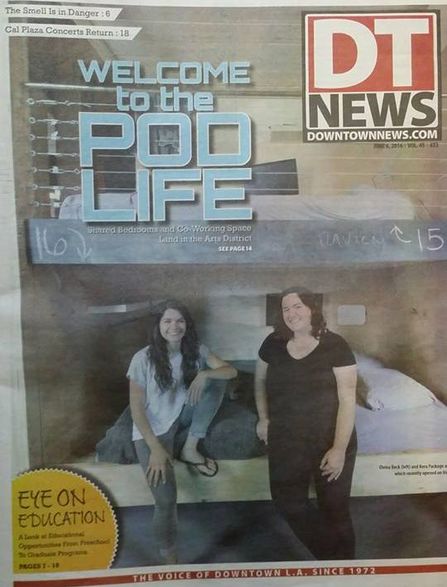

Our company is 4 times larger than this one they featured on the front page of the downtown LA newspaper, like if it's a new thing! We've had Artist Housing's 8,500 sqft dtla location on 8th and Flower since 2012. With our future investments we plan to included a generous budget for media exposure and Public Relations.

|

Local Artist Housing Comparables:

Local Joint Housing Comparables:

Local Loft Comparables:

- Brewery Arts Complex http://www.breweryartistlofts.com/leasing-information.html. Strengths: Considered “The world's largest artist-in-residence community" and Los Angeles Times The quoted it as the "world's largest art complex."Weaknesses: No dogs or musical instruments.

- The Loft at Liz’s: Strengths: have monthly different exhibitions. Weaknesses: Not in downtown (located in Mid-City). No Vacancy.

- 825 Art Studios Strengths: have private studio spaces.Weaknesses: Not in downtown (located in San Pedro). Primarily for painters and photographers.

Local Joint Housing Comparables:

- Rosslyn Lofts: Strengths: Only $800 and includes internet. Allows pets. No deposit? Weaknesses: Income restricted. House section 8 tenants. too many units to share amenities and management and cleaning services cannot keep up with 221 units. Does not include parking.

- Hutington Apartments: Strengths: all included for $499. Weaknesses: Only 1 year leases.$40 application for background check and credit check.

Local Loft Comparables:

- Watermarke Tower: Originally made for condos now converted to apartments because of demand. Opened April 26, 2010, 214 units, 97% occupancy.

- SOUTH VILLAGE – THE MARKET TOP FLATS: 266 loft-style apartments, a 50,000 square foot Ralph’s grocery store and an additional 10,000 square feet of retail space. 100% Occupancy, Completed in 2005.

- Historci Gas Company Lofts: 251 units, Studios starting at $1,500, Across the street and have 96.5% occupancy.

With the above comparables, it is clear to see, demand is high. Once a property is ready for move-in you can expect close to 100% occupancy within 1 month!

OUR MARKETING

Although it's month to month, we have little turn-over. More and more people tend to enjoy the concept of shared housing when it's done correctly.

Our current marketing strategy is detailed below in the same fashion as the end user sees it:

Main features:

· Spacious joint artist housing.

· Tall 12’ ceilings with skylights in each room.

· Gourmet Kitchen with Granite Counters and Stainless steel appliances.

· Soon more improvements as tiled bathrooms and walk in closets.

· Furnished or not option for same price.

· Modern Designs throughout.

Let Us Attend to Your Lifestyle Needs

· 24-Hour Tenant Services

· Maid Service

· Restaurant Reservations

· Packing, Shipping & Mailing

· Dry Cleaning Services

· Nightclub Lists / VIP

· Taxi Cabs & Transportation

· Concert Information & Tickets

· In Home Massage / Stylist

· Maps & Directions

· Studio Tours / Movies, Hollywood

· Pet Services / Dog Walking

· Concierge

· Courtesy Patrol

· Pay rent online or by phone with credit cards.

· Month to month lease- If you don’t like the space give us a 30 day notice.

· Promote healthy living and use low VOC paints, sealants, and cleaning products.

Amenities

· 24-Hour Fitness Center and or complimentary Ballys membership

· Premiere Movie Screening Room

· Private Dedicated Parking with Controlled Access

· Community Laundry room

· Business center

· Community lounge/terrace

· Community roof garden

· Keyless entry

· All utilities included such as cable tv and high speed internet, and of course water, power, trash, sewage, included in rent.

Community Features

· Within walking distance to Staples Center and Metro Station.

· Steps from Ralphs Market.

· Walk to Live, Metro Link, Dining, and Nightlife.

· Close to everything.

Our current marketing strategy is detailed below in the same fashion as the end user sees it:

Main features:

· Spacious joint artist housing.

· Tall 12’ ceilings with skylights in each room.

· Gourmet Kitchen with Granite Counters and Stainless steel appliances.

· Soon more improvements as tiled bathrooms and walk in closets.

· Furnished or not option for same price.

· Modern Designs throughout.

Let Us Attend to Your Lifestyle Needs

· 24-Hour Tenant Services

· Maid Service

· Restaurant Reservations

· Packing, Shipping & Mailing

· Dry Cleaning Services

· Nightclub Lists / VIP

· Taxi Cabs & Transportation

· Concert Information & Tickets

· In Home Massage / Stylist

· Maps & Directions

· Studio Tours / Movies, Hollywood

· Pet Services / Dog Walking

· Concierge

· Courtesy Patrol

· Pay rent online or by phone with credit cards.

· Month to month lease- If you don’t like the space give us a 30 day notice.

· Promote healthy living and use low VOC paints, sealants, and cleaning products.

Amenities

· 24-Hour Fitness Center and or complimentary Ballys membership

· Premiere Movie Screening Room

· Private Dedicated Parking with Controlled Access

· Community Laundry room

· Business center

· Community lounge/terrace

· Community roof garden

· Keyless entry

· All utilities included such as cable tv and high speed internet, and of course water, power, trash, sewage, included in rent.

Community Features

· Within walking distance to Staples Center and Metro Station.

· Steps from Ralphs Market.

· Walk to Live, Metro Link, Dining, and Nightlife.

· Close to everything.

© 2017 All rights reserved. BUSINESS DESCRIPTION MARKET & COMPETITION OUT TEAM HOW TO INVEST POTENTIAL PROPERTIES TO OWNERS TO BROKERS/AGENTS APPENDIX